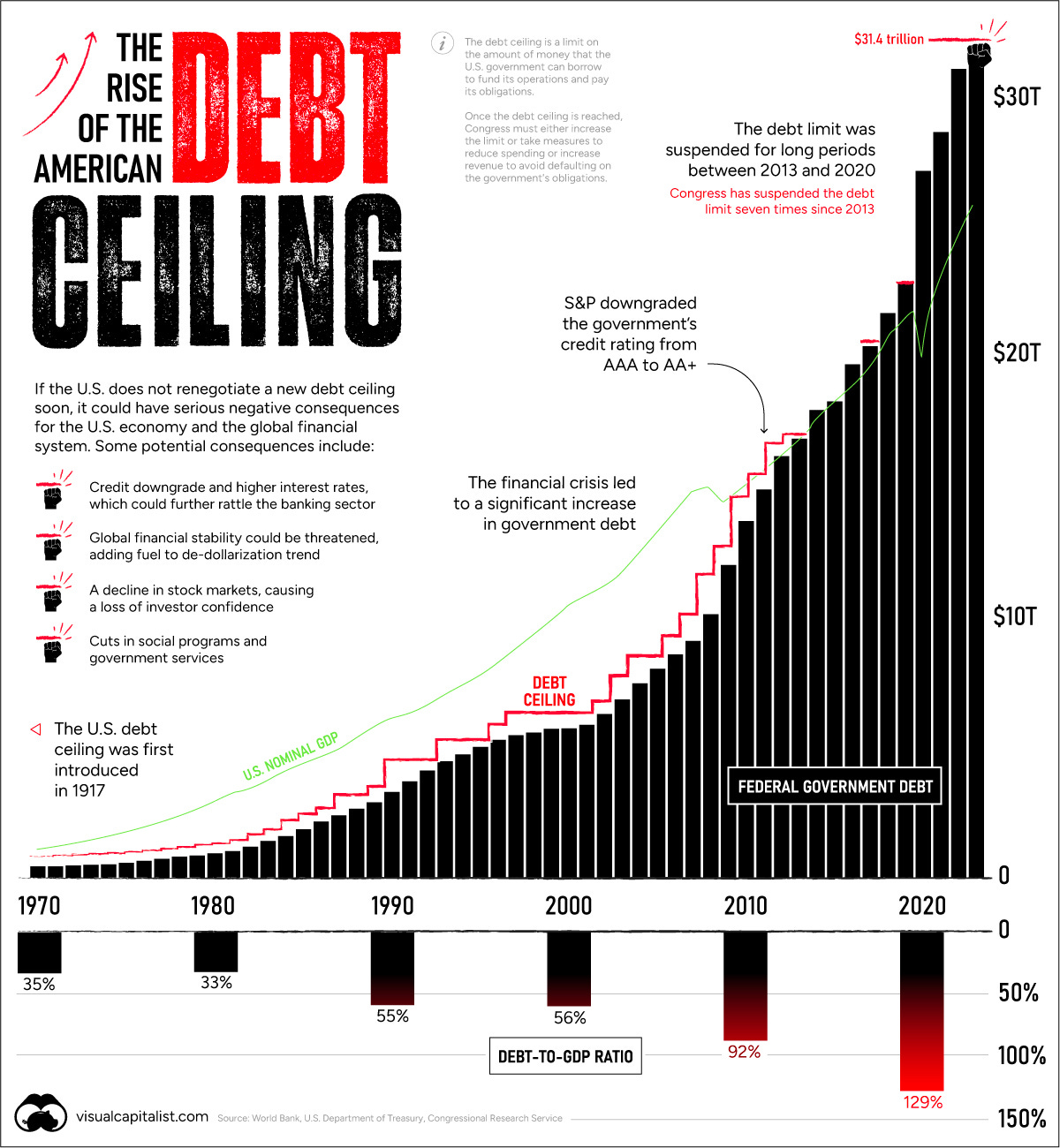

The Debt Ceiling Chart

From the brilliant graphics folks at Visual Capitalist

What happens if we default is simple: S&P downgrades us again, triggering higher interest rates on our debt. More of our debt is held by Japan than by China—and Japan is far less dangerous on this than the behemoth next door. But China still holds a serious chunk of our debt, and they can play hardball about it anytime they like.

Also, a default is like a bankruptcy for a business or individual: it would ruin our credit for a long, long time. And here at home, prices can skyrocket, wages can plummet, and we can wind up in a recession that makes 2008 look like a cakewalk. A US debt default would also undermine global financial stability, generate losses in stock markets, result in cuts in social services programs, and effect a shift away from the dollar as the world’s “gold standard” currency.

A US debt default would be lethal for international confidence in this country, and the beneficiaries would be China and Russia.

P.S. That jump in the debt around 2020, and in the last couple of years, is pandemic-related.